|

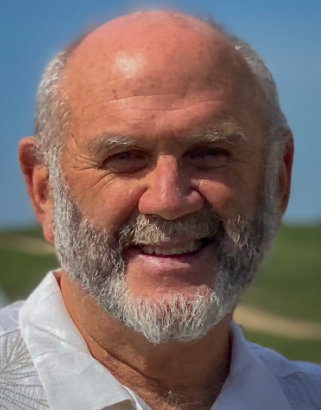

Mark draws on his strong transactional experience, market knowledge and management abilities to successfully lease and operate MKD properties.

Mark joined MKD in February 2021 where he oversees leasing, property management and construction projects for the MKD Portfolio. Prior to joining MKD, Mark was a Managing Director for 16 years in Newmark’s Marin County office completing leasing and investment sales transactions in the local and regional market and has won numerous Power Broker and related performance awards. Some notable transactions include fully leasing the Hamilton Landing project in Novato as well as selling 5 office and industrial buildings to Marin County. Prior to Newmark, Mark worked in marketing roles with both Cushman and Wakefield and Colliers International. A native South African, Mark served as a Company Commander in an elite unit in the South African army before receiving a Bachelor of Arts degree in social sciences and law from the University of Cape Town, South Africa. He further advanced coursework at UC Berkeley in computer network administration and construction management. Mark has also held leadership positions in several community organizations including Board Chair of the San Rafael Chamber of Commerce, President of Marin Highlanders Rugby Club, Chairman of the Marin Cricket Club and Treasurer of the Belden Club. Email: mcarrington@mkdinv.com |

In May 2011, MKD acquired the iconic AMC Kabuki Cinema Complex at 1881 Post Street in San Francisco. Situated at the corner of Post and Fillmore Streets, within the historic Japan Center, the property encompasses a condominium interest across two parcels totaling 27,102 SF, boasting 80,000 SF of gross square footage with 59,462 SF leasable area.

In September 2016, MKD acquired Northpoint Commerce Center, located in West Santa Rosa. This 85,000 square-foot, six-building office and light industrial (flex) property was purchased for $7.4 million, or $87 per square foot. At the time of acquisition, the property was 74% leased and had struggled with occupancy for years. MKD was drawn to this acquisition due to its low price per foot relative to comparable sales and its upside potential through lease-up and hands-on management. For instance, MKD had looked at a similar property in the market being sold at $120 per square foot. Additionally, the seller, an active player in the Bay Area, had a reputation for being difficult and inflexible in leasing the property. MKD believed that with some aesthetic improvements and an aggressive leasing effort, occupancy and rental rates could be significantly increased.

In June 2014, MKD closed a unique off-market investment opportunity, enabled by a strong broker relationship, by acquiring 181,554 SF property on Patterson Pass Road in Livermore, California, on 9.05 acres for $14,524,000 ($80.00 per SF). This property, a traditional two-building concrete tilt-up structure with 309 parking spaces, had been converted into a destination recreational facility at a time when demand from traditional warehouse users was soft and was 85% leased to three tenants. A competing LOI was being negotiated with a syndicator principal but MKD quickly convinced the seller that we were a better buyer with a trade requirement and no need to raise additional equity.

In May, 2007, MKD acquired 3190 Corporate Place, a 83,189 square foot food processing facility. The property, located in a prime industrial area, was part of a company acquisition by Columbus Salami, a company owned by three original Italian families. As part of its expansion strategy, Columbus had recently partnered with a private equity group to bolster its operations and fuel growth. To retain capital for further initiatives, Columbus and its new private equity partners decided to sell the facility but remain on site through a ten-year leaseback agreement. Columbus had retained a broker introduced to the families by MKD and desired a quick transaction. Columbus had clear parameters for the sale and invited MKD, as well as their primary lender, GE, to submit proposals for this unique sale-leaseback opportunity.

|

Clay is highly experienced in completing major acquisitions, forming joint ventures and enjoys strong institutional relationships.

Clay joined MKD in January 2024 after 25 years in institutional real estate including 16 years at PNC Realty Investors (“PRI”) which managed a $6 billion+ Taft Hartley Core Fund. Clay started in the DC office for PRI in a Transactions role and relocated to SF in 2015 where he led the Transactions Team for 7 years and then served as President/Portfolio Manager prior to the Fund being sold in 2023. Prior experience including working at Clarion Partners DC office for 8 years in various acquisitions and asset management roles. Clay’s transaction experience is extensive both nationally and regionally and has included dozens of existing and development transactions in all major product types. Some notable development projects that Clay has worked on include Wolf Point (Chicago-office and residential), 3303 Water Street/22 West (DC-condo), NY Times Tower (NYC-office) and Cadence/Centerra (SSF&SJ-residential). Clay received his BA from UC Berkeley and Masters in Urban Planning from the University of Virginia where he also worked as a graduate intern (the first in a 25-year+ program) for the UVA Real Estate Foundation. Email: cflanagan@mkdinv.com |

|

Bill harnesses his development and entitlement experience, legal expertise and underwriting skills in due diligence and investor relations roles at MKD.

Bill formed PB&J (MKD Partners forerunner) with Pat Flanagan in 2012 and has more than 30 years’ experience in acquisitions, operations, and development, for both publicly traded and private real estate companies with total transactions in excess of one billion dollars. Bill’s experience includes directing acquisition and development for a large publicly listed real estate investment trust and privately held regional companies as well as serving directly as the project sponsor with equity investment partners. At PB&J, and acting in a principal capacity, Bill and Pat have acquired 9 different properties (office, industrial and storage) in partnership with both institutional and HNW investors. Prior to PB&J, Bill acted as a principal and undertook several Northern California real estate opportunities including the redevelopment and disposition of the 700,000 sq. ft. Eastmont Town Center. Previous experience includes working at Prentiss Properties REIT, as acquisitions and development director for Prentiss on the West Coast where he directed investment in core urban and suburban markets. Bill has his undergraduate and law degree from UCLA, and received an MBA from UC Berkeley. |

|

Darla’s expertise in executive functions, capital markets finance, and property performance, optimization, is a key part of MKD’s success.

Prior to establishing and Founding MKD Investments in 2005, Darla was a founding partner of Fowler Flanagan Partners, which acquired more than 200 residential and commercial real estate assets on behalf of real estate investors mainly via syndications on both a national and regional basis. She was the operating partner and managed underwriting, financing, partnership reporting and internal operations, as well as asset management. Prior to forming FFP (and its predecessor entity), Darla served as a Managing Director of JMB Institutional Realty Corporation, where she was employed for 11 years and was responsible for the acquisition over $2 billion in residential and commercial real estate assets, including joint ventures, development projects and real estate companies in the Northwestern U.S. Darla’s skill set includes executive functions and property performance optimization. She brings a wealth of experience in the debt and equity markets as well as acquisition administration and partnership reporting to MKD’s operations and transactions. Darla has been involved in several real estate associations and charitable boards, including the Board of Directors of Catellus Development Corporation, a publicly traded NYSE listed company. She served in this role as an advisor (while with JMB Realty Corporation) to the California Public Retirement System on its $550 million investment in the Company. Darla received a BS in Business Administration from Oklahoma State University and an MBA from the Harvard Graduate School of Business Administration and is a Certified Public Accountant. |

|

Pat leverages his strong transactional experience and deep relationships with owners and brokers to source opportunities and raise capital for MKD.

Pat started his real estate career as an investment specialist at Cushman & Wakefield in 1979 and quickly became one of their top investment specialists nationally contributing in over a billion dollars of transactions covering industrial, retail, office, multi-family, and land assets. During that timeframe, Pat (who also served as its first President) and several other like-minded real estate professionals founded the Belden Club, a networking organization for young real estate professionals that continues to be active and counts an illustrious group of real estate leaders in its alumni. In 1990, he became COO of Iliff Thorn where he oversaw the day-to-day operations of a regional brokerage company consisting of nine offices; and ultimately oversaw the sale of the company to Colliers MaCaulay Nicholls in 1996. He returned to investment sales at Colliers in 1996, teaming up with George Eckard to become one of the premier investment teams on the West Coast before they returned to Cushman & Wakefield. In 2003, Pat left brokerage and teamed up with Matt Moran and Michael Joseph to form FJM Investments to acquire real estate. Their first transaction was the largest industrial transaction to exchange hands in the Sacramento market at that time. In 2005, Pat moved on to start MKD Investments with Darla, a family office real estate investment platform, where they have been investing since that time. In 2012, recognizing an opportunity to acquire quality real estate assets at the bottom of the market, Pat founded PB&J to leverage the fallout of the 2008 recession. Pat received his undergraduate degree from UC Davis and an MBA from UC Berkeley. |

West Covina Center is a 122,756 rsf Shopping Center located along I-10 in West Covina, California. It is anchored by Floor & Décor who occupies 83% of the Center under a 15-year lease. The acquisition was for a leasehold interest that had 15 years remaining on the lease with no additional extension options. Prior to a full renovation for Floor & Décor in 2021 the building was home to Sears, Roebuck & Co. since the 1960’s. The leasehold was acquired for $7,060,000 ($57/rsf) in December of 2021.

21-23 Pimentel Court is a two-building industrial, property totaling 56,938 rsf, located in Novato, California. Each building was leased to a separate tenant, with 21 Pimentel leased to Biomarin Pharmaceutical with five years of lease term remaining and 23 Pimentel leased to Prima Fleur Botanicals with two years of term remaining. 21-23 Pimentel was one of the highest quality industrial properties in the small Marin County market with rare clear height and dock-high loading. We purchased the property in 2015 for $10,750,000 ($192/sf).

Hopper Storage and Industrial Park is a 14-building, 203,000 rsf commercial property located in Santa Rosa, California. It is a unique property that was a private airport in the 1950’s and 1960’s. It hosts a combination of uses including, self-storage, small warehouse and large industrial users. At acquisition it was well leased at 95% occupancy but the average rental rate was around 60% of market with many of the tenants on short leases or month to month. The property was acquired in July of 2022 for $24,100,000 ($119 rsf).

Sequoia Court is a 3-building office/industrial flex development in Petaluma, California, totaling 87,831 rsf. The property was acquired from a family that decided to sell its real estate and was represented by a brokerage team very well known to MKD. The property was acquired in June of 2011 for $5,090,000 ($58 rsf). The property was 60% leased at acquisition and the 3 largest tenants had less than 2 years of term remaining.

770 L Street is a 169,078 rsf, 13-story office tower located one block from the Golden One Arena in downtown Sacramento, California. The property was acquired in July of 2013 for $29,400,000 ($173/rsf) and was 65% leased at acquisition. The Seller had recently done extensive capital repairs to the major systems and the building, which was originally built in 1984, had been fully renovated in 2005.

The Press Democrat was a 73,000 rsf industrial building sitting on an underdeveloped 12.7-acre parcel of land in Rohnert Park, California. The property, was purchased for $9,500,000 in September of 2016 as a covered land play. It was acquired with the assistance of local brokers in a non-marketed sale lease back transaction.

The Petaluma Valley Portfolio consisted of 14 separate office, industrial, medical and retail properties totaling 840,637 rsf, located in Petaluma and Rohnert Park, California. The Portfolio was 70% leased at acquisition in 2012 including leases with several high quality, institutional credit tenants. Most of the portfolio was built in 1997 or later and represented the best located, most attractive space in the market. We purchased the Portfolio for $65,000,000 ($77 rsf) which was about a third of replacement cost