About MKD

20+

years of spectacular returns

Who is MKD Partners?

MKD Partners is the combination of several successful real estate platforms and individuals that has evolved over the past 20+ years. With the goal of continuing to generate market-leading returns through co-investment with qualified High Net Worth Individuals, Sub-Institutional and Institutional Investors, MKD is leveraging favorable market conditions to expand its high-yield portfolio and leverage its impressive financial resources. We are not a fund, we focus our investment activities on the basis of opportunity, not pressure to invest. In doing so we are able to focus on offerings we want to coinvest in. Please Contact MKD for information and investment opportunities.

MKD Team

Click on image to read bio

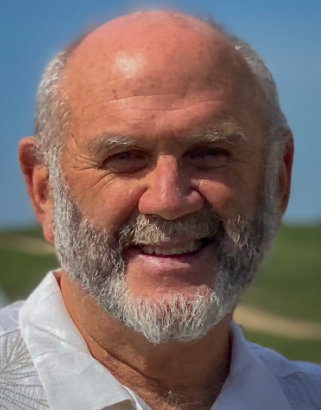

Patrick Flanagan

Click on image to read bio

Darla Flanagan

Click on image to read bio

Bill Sumski

Click on image to read bio

Clay Flanagan

Click on image to read bio

Mark Carrington

MKD's Background

- In 2005 Pat Flanagan and Darla Flanagan founded MKD Investments as they transitioned their own successful real estate careers into a family office investing on their own account, growing the MKD Portfolio to 19 commercial properties (16 wholly-owned) in the Greater Bay Area and 2 properties in Southern California.

- With deep industry relationships and extensive experience in transactions, finance and operations, Pat and Darla saw the opportunity to capitalize on the recovery of real estate markets in 2012 and partnered with Bill Sumski to form PB&J Partners. As an investment arm of MKD, they leveraged a significant balance sheet generated from their investment activities with outside investment from both institutions and the partners’ own network of high-net-worth investors. Bill’s strength and experience in due diligence, development and construction, real estate law, and management were complementary skills that filled out the team.

- Based on a decade of successful projects providing excellent returns for its investors, MKD has identified another excellent time to grow its outside capital investment platform and added Clay Flanagan, a seasoned institutional fund manager, and Mark Carrington, a top-producing investment sales and leasing broker with experience throughout the San Francisco Bay Area, to the team to both find new opportunities and enhance operations.

MKD's Strategy

MKD Partners employs an opportunistic strategy based upon identifying and realizing maximum value in a measured risk-adjusted manner. MKD is not a momentum player – although we will capitalize on it. The strategic focus is on commercial real estate (industrial, self storage, retail and select office) in proximate drive-to locations within our targeted Northern California markets. We execute this strategy by following MKD’s tried-and-true process.

Opportunity Identification

With deep and meaningful relationships in the Northern California brokerage and ownership communities, we are able to identify unique opportunities that fit our criteria and process. We frequently transact with former colleagues and principals who know our abilities to efficiently close on a transaction. We are not a fund and have no pressure to transact therefore allowing us to select opportune spots for investments. Historically have personally funded 25% to 50% of the equity in transactions where we invite outside investment.

Hitting the Ground Running

When we close on an asset, we have already mapped out our strategy and are fully prepared to operate the property. We retain the best leasing and operations team in the particular market for the given product type. We want to make sure we see any available leasing opportunity for the particular project and optimize expenses. We use a partner in charge approach and do not delegate oversight of our assets. Given our large equity investments in each transaction, we have a clear stake in successful outcomes.

Operations

MKD believes that an active principal role in property operations leads to enhanced cash flow and boosts residual value. MKD’s extensive experience in our targeted markets, our market knowledge and work with top leasing brokers in our markets contribute to leasing success, tenant retention and minimization of downtime in MKD Transactions. Our attention to detail, ability to manage documentation in-house, management and construction experience, and in-house accounting acumen allow MKD to operate our properties most effectively and efficiently. We have a unique insurance program that allows us to bundle our properties to achieve significant savings while maintaining superior coverage.

Financing

Our financing relationships, deep knowledge of the capital markets, and creativity have been a critical element in boosting returns on MKD Transactions. Our strong balance sheet provides flexibility and the ability to apply the most accretive available financial solutions for any investment. We carefully balance the right amount of debt on a given transaction, rather than simply attempting to put on as much debt as the market will allow.

Disposition

MKD’s insightful knowledge of market conditions and thorough due diligence helps determine the point in the investment where the asset will have more value to a potential buyer than it will have to the partnership. As principals and brokers we have sold hundreds of properties and identify our exit strategy at acquisition. MKD is very experienced in identifying and closing on 1031 exchange properties, providing opportunities to further increase returns through tax deferral.